Owners And Contractors Protective Liability

Sub Contractor Insurance

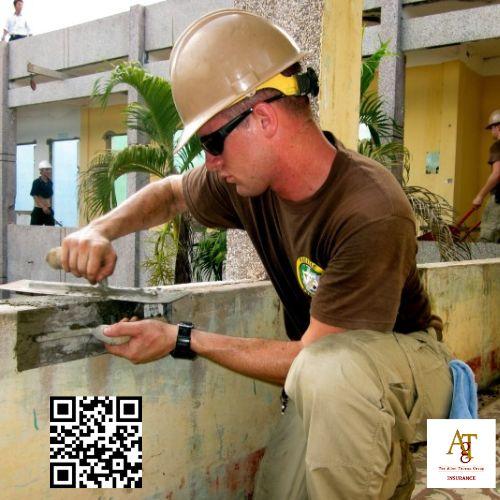

Independent contractor insurance varies significantly across industries. Independent contractor insurance varies significantly across industries.

Having the right property damage insurance coverage is essential for contractors to protect themselves and their clients from potential liabilities. Having the right property damage insurance coverage is essential for contractors to protect themselves and their clients from potential liabilities.