General liability coverage protects businesses against common business risks like customer injury, property damage, and advertising injury claims. An additional insured is defined as any person covered by an insurance policy other than its policyholder, who enjoys less coverage but still gains crucial protection, including:Defense Coverage. Assists you with covering medical expenses and legal fees associated with defending against an event covered under this plan. The type of contracting business you own as well as its size and location will impact what types of insurance policies may be necessary. A knowledgeable insurer is essential to your success - our Risk Control, Underwriting and Claim professionals specialize in your industry and can assist in managing complex indemnity, additional insured and contractual exposures more effectively. A knowledgeable insurer is essential to your success - our Risk Control, Underwriting and Claim professionals specialize in your industry and can assist in managing complex indemnity, additional insured and contractual exposures more effectively.

We offer insurance through phone, online and independent agent channels; costs vary based on how you buy. Business auto insurance - Covers liability and damage involving vehicles used for business purposes like work trucks.

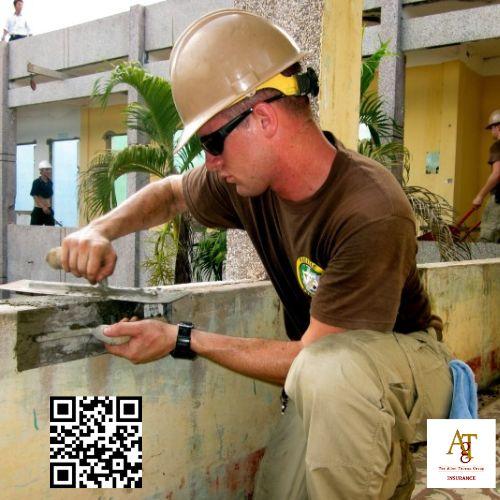

contractor insurance . Here are three coverage options that contractors should consider:1. Each job site brings potential for injuries, property damage, and costly lawsuits. Each job site brings potential for injuries, property damage, and costly lawsuits.

People who work for themselves and don’t have any employees generally aren’t required to have workers’ comp insurance, but it's still a good idea to carry coverage. Contractors should carefully review their insurance requirements and consult with an insurance professional to determine the appropriate coverage options for their specific needs.