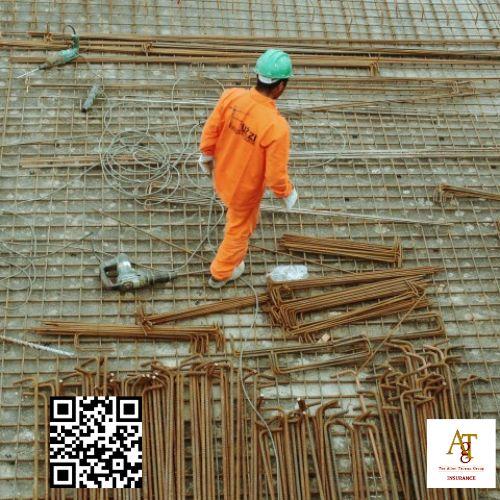

Insurance For Concrete Contractors

Builders Risk Insurance Quote

That's why The Allen Thomas Group has a specialized construction claim service operation to focus on these unique claims. That's why The Allen Thomas Group has a specialized construction claim service operation to focus on these unique claims.

Additionally, contractors should compare quotes from different insurance providers to ensure they are getting the best coverage at a competitive rate. Additionally, contractors should compare quotes from different insurance providers to ensure they are getting the best coverage at a competitive rate.