Demolition Contractors Insurance

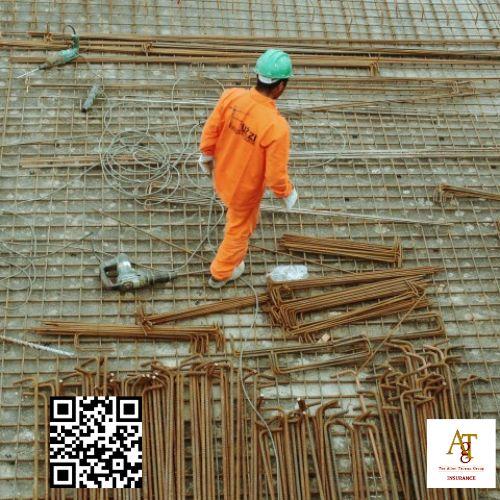

General Contractor Workers Compensation Insurance

As an independent insurance agency, The Allen Thomas Group has the experience, carrier access and resources to protect contracting businesses. Requiring Surety Bonds is common practice for commercial construction and public works projects. Requiring Surety Bonds is common practice for commercial construction and public works projects.

If a third party sues the additional insured over work done for the business, the general liability insurance policy can address the claim. Contractors insurance usually covers business liability exposures, such as injuries or damage to a client’s property for which your business is responsible. Contractors insurance usually covers business liability exposures, such as injuries or damage to a client’s property for which your business is responsible.

Timelines, change orders and contract administration can add additional stressors. Some independent contractors are required to have this coverage to work in riskier professions, such as roofing and building trades. Some independent contractors are required to have this coverage to work in riskier professions, such as roofing and building trades.

All content and materials are for general informational purposes only. Your cost depends on several variables such as the extent of coverage you require, your specific trade and location. Your cost depends on several variables such as the extent of coverage you require, your specific trade and location.