Lawn Care

Landscaping local to Nooksack, Washington

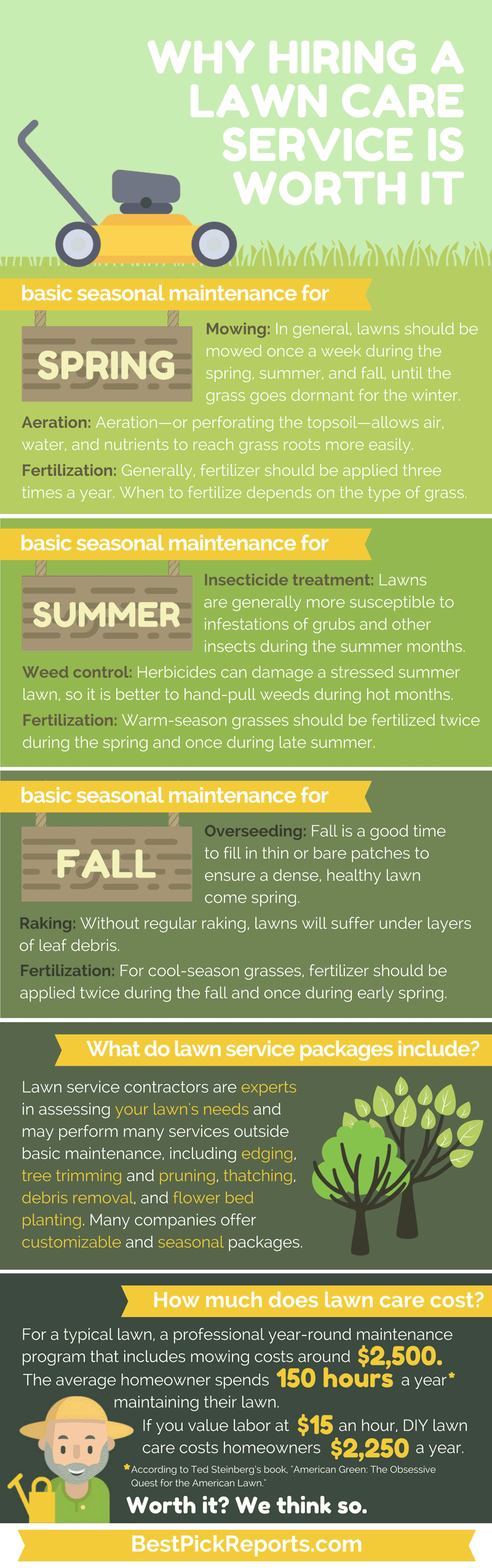

trying to DIY your lawn treatment or neglect it entirely. To truly comprehend if it's worth it to work with a yard treatment business, you have to recognize what you're spending for. Reviewing several of these crucial functions a specialist gives the table can help you better understand the prices entailed.

This training is important so technicians are upgraded on application methods, brand-new items for treating certain grass care issues, and everything in between. We discuss the ideal walking rate when making use of fluid items vs. granular products, calibrating devices effectively, and determining numerous weeds and illness. These points can make the distinction between a rich, eco-friendly grass and one with yellow locations, bare areas, and lots of weeds.

This is the same with lawn care products. Some crucial products can do marvels when it comes to tackling particular yard treatment problems.

An expert yard care business reveals up to your home a specific variety of times each year, and each browse through consists of one or more applications, depending on the moment of year, your lawn's specific issues, and the level of service you joined to get. Is yard treatment service worth the expense? This is where specialist lawn treatment applications can make a substantial distinction.

Lawn Care

You 'd likewise need to be outdoors monitoring your grass regularly to identify obstacles. And you can't let points like summer vacation or time appreciating your landscape obtain in the way. When you employ a professional, you do not need to fret about anything besides knowing the amount of visits and applications they enrolled in.

If you do landscape design or yard or plant care, you must be collecting sales and use tax obligations. Landscaping and grass and plant care services include any kind of job you do to preserve or improve grass, yards and decorative plants and trees. You ought to accumulate state tax, plus any kind of neighborhood tax obligation (city, region, special objective area or transportation) on the complete fee for these services.

The specialist solutions of landscape designers and engineers are not subject to sales and use tax. These solutions include assessments, study, preparation of style plans and other design or architectural solutions. You ought to divide your cost for nontaxable expert solutions from any kind of charges for taxable landscaping services, or the overall fee will certainly be presumed taxed if the taxed section is more than 5 percent.

Snow Removal

Be sure to different landscape design fees from charges for brand-new building and construction or for fixing or renovation due to the fact that different policies use. Nonresidential genuine residential property repair work or improvement is a taxed service. The provider have to collect sales tax on the complete cost to the customer for materials, labor and various other expenses.

If the agreement is separated (separate fees for labor and materials), the professional collects sales tax obligation from the consumer on the fees for products yet not for labor. An apart professional might buy the structure products tax-free by issuing a resale certificate. Describe Regulation 3.291, Professionals. Landscaping and grass treatment are not taxed when bought by a service provider or homebuilder as component of the improvement of real estate with a new home.

The landscaping materials made use of for brand-new property structures are taxable. In a round figure agreement (one amount for materials and labor), the landscaper pays tax obligation when buying the products and does not collect tax obligation from the customer. If the agreement is separated (different charges for products and labor), the landscaper gathers tax from the specialist or homebuilder on the charge for products and can offer a resale certificate when acquiring materials.

These products are transferred to the care, guardianship and control of your customer as part of your taxed service. When landscaping a brand-new residential structure for a professional or homebuilder, bear in mind the difference between round figure and separated contracts in paying or gathering tax on these materials. You need to pay sales tax obligation on the supplies and equipment made use of in landscape design and lawn care.

Occasionally you might work with a 3rd party to supply a few of the landscaping services that you market. In that case, provide the 3rd celebration a resale certificate rather than paying sales tax and gather tax obligation from your client on the overall charge, consisting of the 3rd party's charge. 94-112(03/2022).

Landscape Design

You can make hay while the sun beams. However you will either have to shut shop for a few months or locate a new hustle in the winter. And considering that the difficulties to go into the yard care organization is rather low, it's likewise among one of the most competitive local business available.

Regardless of the difficulties stated above, the overall pros of owning a yard care business outweigh the disadvantages. For beginners, you can start your very own yard treatment organization either by pooling in your rainy-day financial savings or obtaining a personal bank card financing for under $10,000. That's since the initial investment expense for beginning a yard treatment organization is unbelievably reduced.

From being a $69.8 billion market in 2013, the market for yard treatment and landscape design has actually expanded greatly and is shutting in on being a trillion-dollar sector pretty quickly.

That suggests you affordable lawn maintenance near me trulawnlawncare.com will never have a trouble locating organization as long as your neighbors' turf blades expand tall. Include in that the benefit of being a neighborhood organization owner. Most grass treatment organizations get their customers by leveraging their network in the neighborhood area and with word-of-mouth references. There's extremely little knowing curvelike just how to make use of the equipment, how to red stripe a yard, or just how to develop your lawn mower blades, whether to grass-cycle or bag the grass trimmings to the local garbage dumps, and so forth.

Landscape Design

It's a simple company concept that will essentially turn environment-friendly turf to eco-friendly cash. And in case you're fretted about its seasonal life expectancy, lawn care is a service you can easily work on the side while maintaining your main income source alive. With the ideal sort of preparation and preparation, lawn treatment is the sort of organization that every person can run profitably.

You will need a start-up budget to open your lawn treatment company. Luckily for yard treatment businesses, the first investment is not that expensive.

401(k) are tax-free retirement savings that practically every functioning professional will need to their name. In the United States, it's the second most preferred form of service financingright after straight cash investmentfor Americans to finance their brand-new business. If you have a 401(k) cost savings, you can withdraw it to fund your yard care business start-up.

Snow Removal in Nooksack

The majority of these financings have reduced rate of interest and flexible payment terms in comparison to the car loans you could take directly from a financial institution. As opposed to the lendings that you could take straight from a personal financial institution, you will certainly have the low passion rates and long-term settlement program if you select the funding choices from SBA.

So it's the low-risk arrangement for both you and the lending party. 3. You can obtain a personal or credit score card funding to fund your lawn care business, given you have an above-average credit report (690 and above). There are some very good advantages to taking these short-term car loans. You won't need to risk your individual property or a collateral asset.

And if approved, the handling of the loan amount doesn't take greater than 34 days. The dangers included in taking unsafe lendings is that the rates of interest can be rather high. Payday car loans are the worst kind of short-term finances that come with surprise terms and conditions and undesirable shocks.

Trulawn, 212 W 1st St, Nooksack, WA 98276, (360) 319-3216, https://www.trulawnlawncare.com